Australia's share market has logged its worst session in 10 months, after US tech worries and aftershocks from the precious metals sell-off hammered risk sentiment.

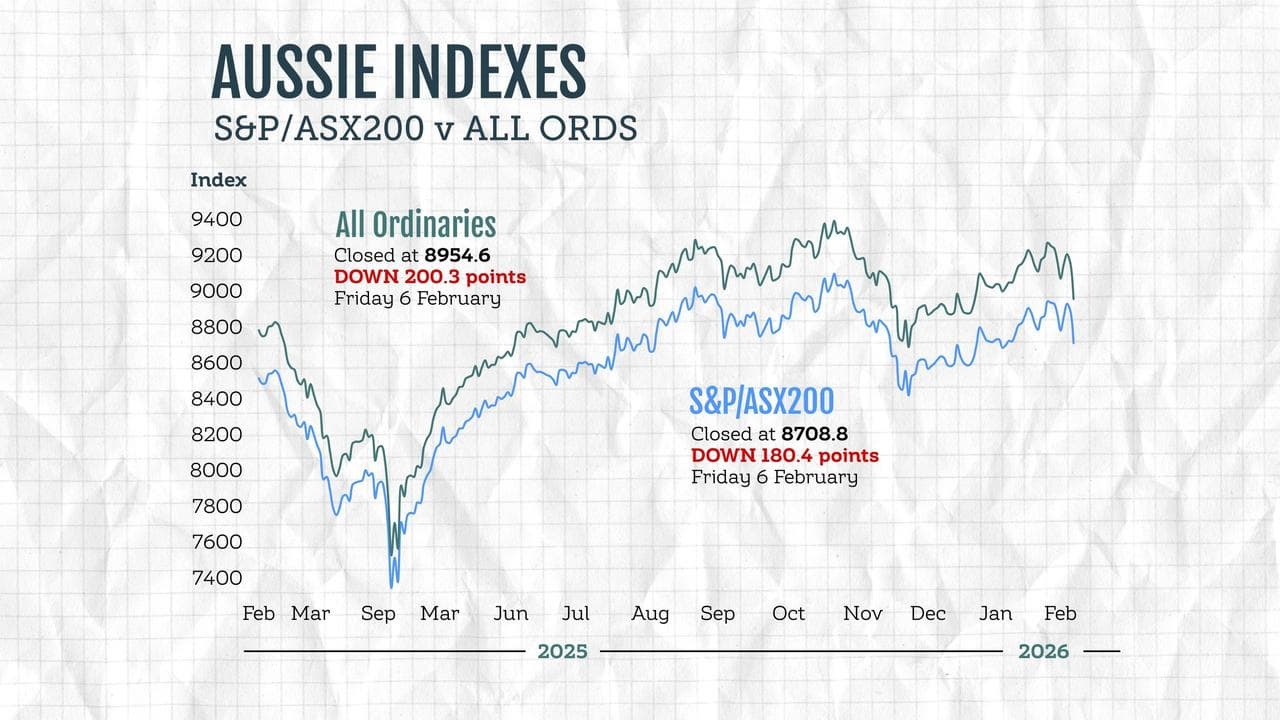

The S&P/ASX200 fell 180.4 points on Friday, down 2.03 per cent, to 8,708.8, as the broader All Ordinaries tumbled 200.3 points, or 2.19 per cent, to 8,954.6.

It was the top 200's biggest daily drop since April, when US president Donald Trump's Liberation Day tariff announcements sent global equities into a tailspin and pummelled global growth expectations.

“There's just a lot working against the market at the moment,” Capital.com senior market analyst Kyle Rodda told AAP.

“We've seen that weakness come through Wall Street Tech, mostly on renewed fears about artificial intelligence ROI, and then I think we're seeing the blowback of the sell off of precious metals, which is spilling over to other areas of the market."

All 11 local sectors tumbled at least one per cent, while energy, raw materials, consumer cyclicals, communications, IT and real estate stocks dived two per cent or more.

Gold miners bled lower as the precious metal continued to fishtail from its recent sell-off, trading hands at $US4,846 ($A6,972) an ounce, dragging Denver-headquartered Newmont almost five per cent into the red.

Silver's sell-off has been even more brutal, with more than a third of precious and industrial metal vanishing since last Friday and effectively wiping all of January's nearly parabolic gains.

BHP weighed heavily, down three per cent to $48.79, as Singapore iron ore futures slipped below $US100 a tonne for the first time this year.

Rio Tinto ended the session just below flat, with investors heralding its decision to walk away from Glencore's latest merger offer as disciplined.

Mixed miners, copper plays, rare earths producer and battery minerals stocks also fell.

The heavyweight financials sector couldn't offer any support, shedding 1.2 per cent as the big four banks and most of the sector lost ground.

Real estate stocks underperformed the broader market, dropping 3.9 per cent, with the Reserve Bank's interest rate hike earlier in the week further dampening the segment's fortunes.

Energy stocks lost 2.7 per cent, despite oil prices firming ahead of nuclear talks between the US and Iran in Oman later on Friday.

Elsewhere, coal producers fell and uranium miners sold off sharply, with Paladin Energy down more than 10 per cent on broader weakness and jitters around AI demand and the global data-centre build-out.

The worries also weighed on ASX-listed IT stocks, which dropped to their lowest value since December 2023 during the session.

A 2.4 per cent sell-off in consumer discretionary stocks came as Web Travel plummeted almost 30 per cent on news its Spanish arm is being audited by the national tax agency.

Cryptocurrency Bitcoin tanked to its lowest price since October 2024, caught up in de-leveraging not only of crypto positions, but as traders panic-sold to cover leverage on their precious metals losses.

In company news, real estate digital advertising firm REA group traded more than seven per cent lower after its first half results undershot expectations and warned property listing could fall as much as three per cent this financial year.

The Australian dollar is buying 69.55 US cents, down from 69.72 US cents on Thursday at 5pm.

ON THE ASX:

* The S&P/ASX200 fell 180.4 points, or 2.03 per cent, to 8,708.8

* The broader All Ordinaries fell 200.3 points, or 2.19 per cent, to 8,954.6

CURRENCY SNAPSHOT:

One Australian dollar trades for:

* 69.55 US cents, from 69.72 US cents at 5pm AEDT on Thursday

* 109.04 Japanese yen, from 109.42 Japanese yen

* 58.96 euro cents, from 59.13 euro cents

* 51.26 British pence, from 51.18 British pence

* 116.37 NZ cents, from 116.44 NZ cents