The local share market has finished slightly higher, with an attempt at a broader relief rally losing steam throughout the afternoon.

The benchmark S&P/ASX200 index on Tuesday finished up 7.8 points, or 0.12 per cent, to 6,780.7, while the broader All Ordinaries rose 7.3 points, or 0.1 per cent, to 6,967.5.

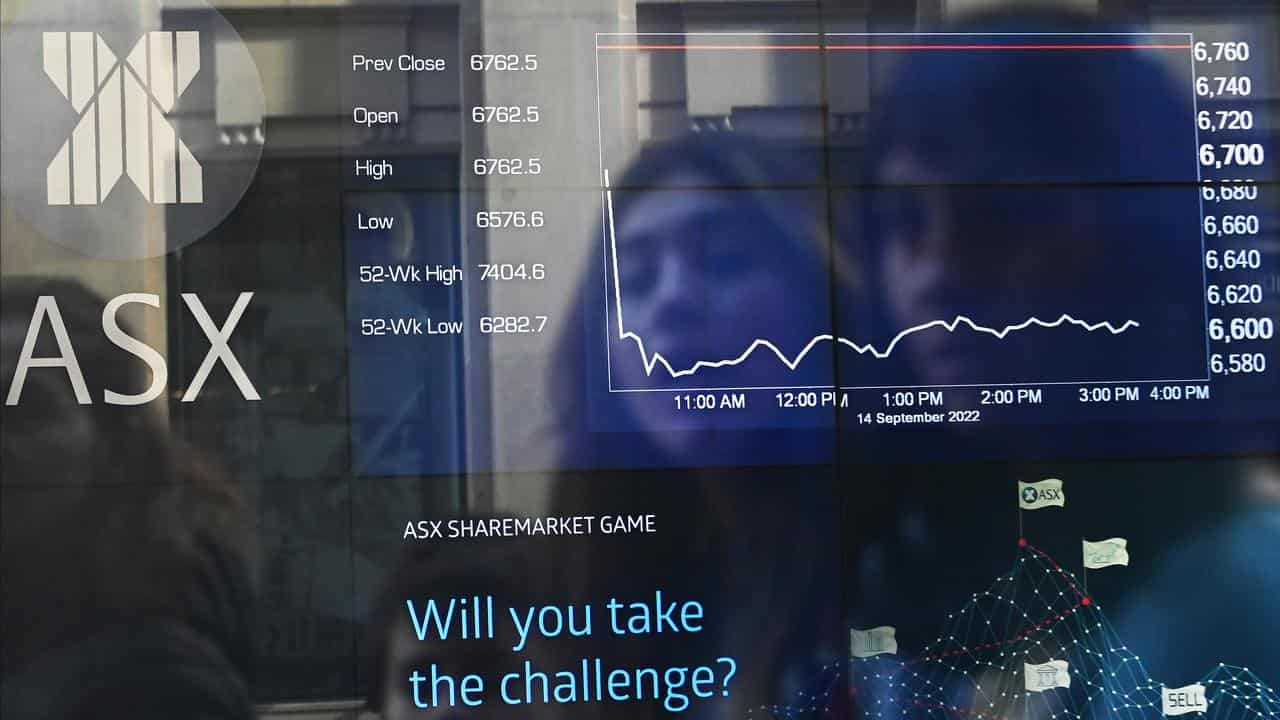

The ASX200 dropped 3.8 per cent during October, its third straight month of losses and its worst monthly performance since a 7.3 per cent drop in September 2022.

Tuesday began with gains of as much as 0.6 per cent in the first hour of trading as Israel's incursion into Gaza showed more restraint than the shock-and-awe tactics some had expected, easing fears the fighting would escalate into a regional conflict.

But the market was later dragged as China manufacturing data known as the official purchasing managers' index showed activity unexpectedly shrinking in October, renewing jitters about the health of the world's second-largest economy.

Accordingly the mining sector was the biggest loser on Tuesday, dropping 1.1 per cent as BHP fell 1.4 per cent to $44.50, Rio Tinto dipped 0.6 per cent to $117.58 and South32 subtracted 0.3 per cent to $3.32.

Goldminers dipped as the price of the precious metal unwound slightly to $US1,993 an ounce, with Newmont dropping 1.5 per cent to $60.41.

The property sector was the biggest gainer, rising 1.1 per cent as Dexus added 2.9 per cent and Goodman Group added 1.3 per cent..

Inghams had climbed 7.9 per cent to a nearly two-year high of $3.68 as the poultry producer said it expected to post a first-half profit of around $65 million following strong demand for poultry and further improvements in wholesale pricing.

InvoCare rose 1.1 per cent to $12.66 after shareholders approved the funeral home owner's $1.8 billion, $12.70-per-share takeover by TPG Capital.

InvoCare will be delisted from the ASX on Friday. It'll be replaced in the ASX200 by Emerald Resources NL, a Perth-based company that owns a goldmine in eastern Cambodia.

Origin Energy was down 0.4 per cent to $9.13 on a quarterly update and after AustralianSuper flagged it would vote against its acquisition by Brookfield and EIG.

All of the Big Four banks finished higher, with CBA up 0.4 per cent to $96.56, NAB adding 0.6 per cent to $28.05 and ANZ and CBA both gaining 0.7 per cent, to $24.71 and $96.56, respectively.

The Australian dollar was buying 63.53 US cents, from 63.54 at Monday's ASX close.

ON THE ASX:

* The benchmark S&P/ASX200 index finished Tuesday up 7.8 points, or 0.12 per cent, at 6,780.7.

* The broader All Ordinaries rose 7.3 points, or 0.1 per cent, to 6,967.5.

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 63.53 US cents, from 63.54 US cents at Tuesday's ASX close

* 95.41 Japanese yen, from 95.03 Japanese yen

* 59.92 Euro cents, from 60.16 Euro cents

* 52.30 British pence, from 52.44 pence

* 108.91 NZ cents, from 109.03 NZ cents.