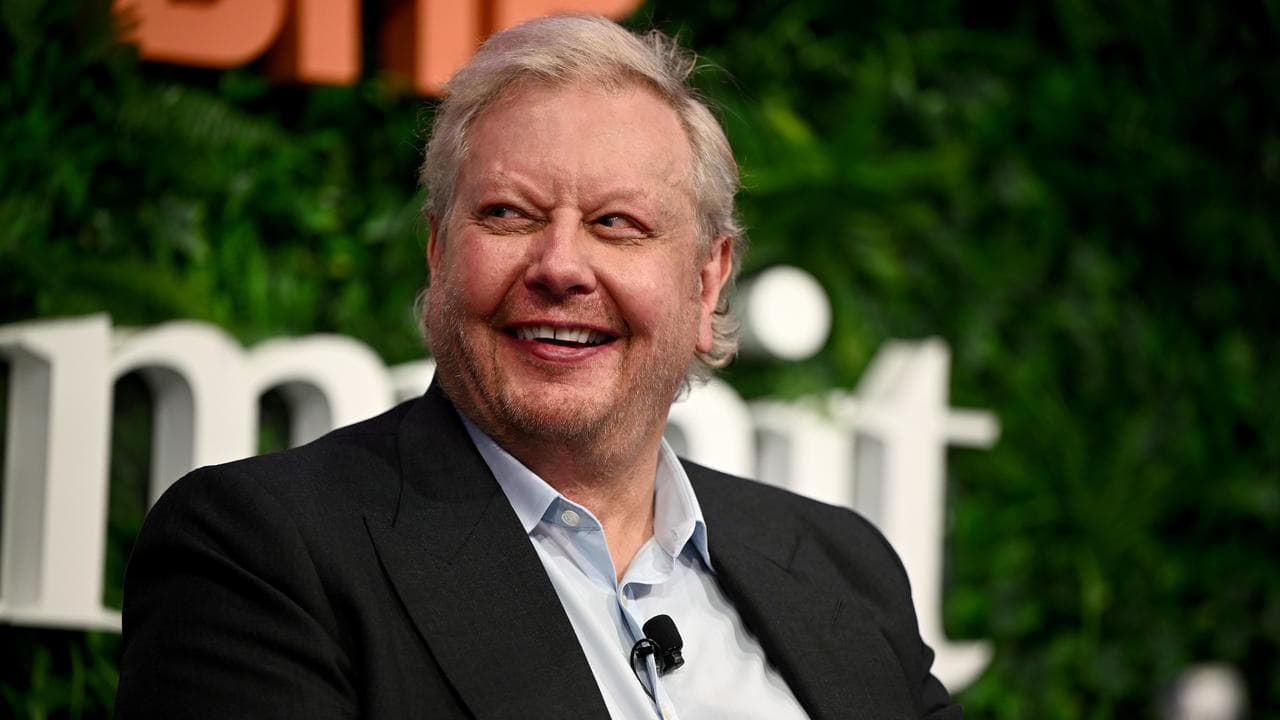

Billionaire tech entrepreneur Richard White has taken control of WiseTech Global, the logistics company he founded three decades ago, following the resignation of two-thirds of its board earlier this week.

Mr White has been appointed WiseTech's executive chairman while the ASX's biggest tech company searches for a permanent CEO, WiseTech said in a statement on Wednesday.

WiseTech directors Lisa Brock, Richard Dammery, Michael Malone and Fiona Pak-Poy resigned on Monday, citing "intractable differences" about the role of Mr White, causing WiseTech shares to plunge 20 per cent.

Two weeks earlier the board said it was considering two confidential complaints making allegations about Mr White, one from an employee and one from a supplier.

Mr White stepped down as WiseTech's CEO in October, as the board hired two law firms to review "specific issues raised in recent media coverage," including about his personal life.

He instead took the title of "founder and founding CEO" at the same $1 million salary while an interim CEO was named.

WiseTech said a month later that an inquiry by Herbert Smith Freehills and Seyfarth Shaw LLP had cleared Mr White of five specific allegations, including that he had misused company funds, failed to disclose close personal interoffice relationships and had engaged in workplace bullying.

The board's inquiry is continuing but will now be led by Mike Gregg, a venture capitalist who is returning to WiseTech's board following the resignation of the four other directors on Monday.

Mr Gregg, who served on the board from 2006 to 2022, will receive a briefing from Seyfarth Shaw in the coming days as to the status of its investigation.

WiseTech said it expects to appoint another independent board member to its board within four weeks so it complies with ASX listing rules, which require that its audit and risk committee compromise at least three non-executive directors.

The governance drama largely overshadowed WiseTech's other announcement on Wednesday, its half-year results.

WiseTech reported it had made $US77.1 million in profit in the six months to December 31, up 38 per cent from a year ago.

Revenue was up 17 per cent to $381 million.

RBC Capital Markets analyst Garry Sherriff said it was a solid result for WiseTech, while eToro market analyst Farhan Badami said a cost-cutting program by the company had delivered better-than-expected results that should push profit margins to the top end of guidance.

"But investors now face a tough decision," said Mr Badami. "Do they focus on the strong financial performance or worry about the leadership drama?"

WiseTech makes a cloud-based cargo platform used by freight forwarders and others to manage supply chains around the world.

Mr White holds a nearly 37 per cent stake in the $32 billion company, whose shares were up 2.1 per cent to $96.68 on Wednesday afternoon.