Australia's largest chicken supplier has plucked its full-year forecast by millions of dollars after rising costs dented interim earnings, pushing its shares down by more than 16 per cent.

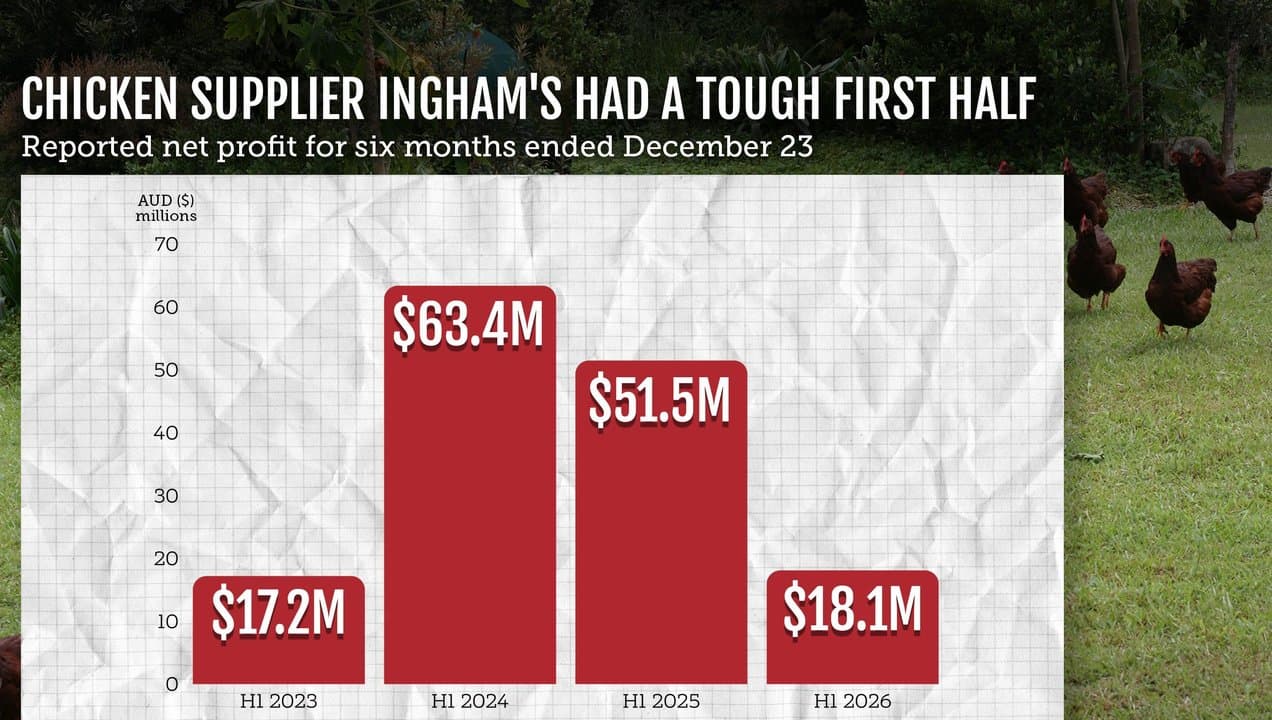

Inghams Group, which farms, processes, and sells chicken and turkey products, saw its first half net profit plummet by almost 65 per cent to $18.1 million - the lower end of analysts' expectations.

Revenue for the six months from its Australian and New Zealand operations ended December 23 was flat at $1.6 billion, while underlying earnings dipped 33.8 per cent to $139.2 million, albeit better than expected.

Inghams CEO Ed Alexander said the first-half result was disappointing and reflected the cost of managing excess inventory - mainly processed chicken and turkey - and supply chain transition.

The poultry supplier also faced cost headwinds in its Australian operations, as group costs for the half rose five per cent to $69.7 million.

Cost inflation was seen across labour, ingredients and cooking oil, utilities and packaging.

Inghams also continued to move its poultry growers to performance-based contracts - a process that's been ongoing for 18 months - resulting in an operating cost of $29.5 million.

"I want to emphasise that the fundamentals of our business are strengthening," Mr Alexander told analysts on an earnings call.

"The improved inventory position has enabled a return to normal production settings, which is supporting improved unit costs.

"We have clear actions in place to reduce supply chain costs and ... this implies a materially stronger second half performance relative to the first."

Inghams sells products to supermarket giant Woolworths, but now at a lower volume after a new supply contract was settled last year, although this was offset by gains for other retailers.

In total, it funnelled through almost 233 kilotonnes of chickens and turkeys in the first half, as the core net selling price increased 1.4 per cent to $6.43 per kilo - its best in at least four years.

But the core price for quick service, or fast food, restaurants fell 1.2 per cent after it struck a new supply agreement with Nandos, and after taking into account a lower price per kilo for McDonalds, which offers McWings meals.

Inghams cut its full-year underlying earnings guidance to between $180 million and $200 million, from $215 million to $230 million previously.

But Mr Alexander said the guidance change was driven by the timing of the flow through of benefits from business changes, and he expected to see improved earnings momentum going into 2026/27.

The company's share fell by more than 16 per cent to a record intraday low of $1.97 before recovering somewhat to end at $2.11, down 13.5 per cent.

Inghams will pay an interim dividend of four cents.