Shares in a Sydney-based multinational insurance company have hit a four-month high after the firm hiked its dividend and exceeded its financial plan for 2025.

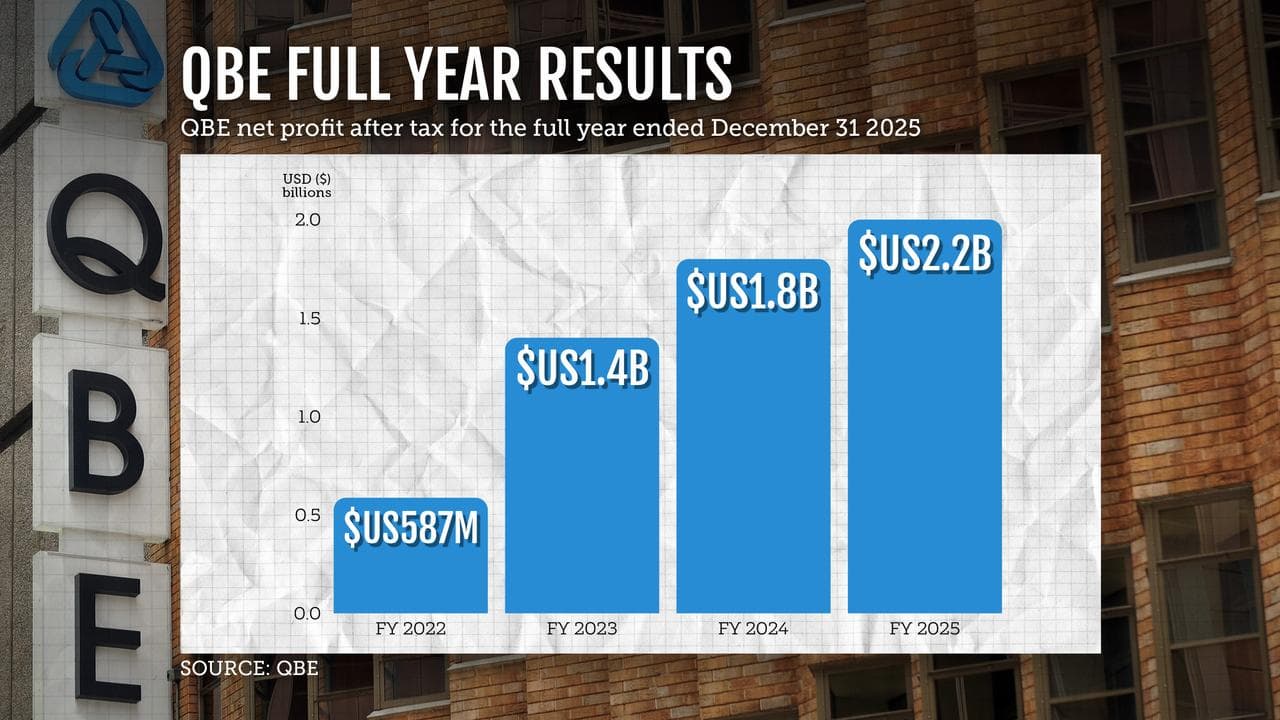

QBE on Friday announced its full-year net profit for 2025 rose 21.2 per cent to $US2.2 billion ($3.1 billion), as gross written premiums climbed 7.0 per cent to $US24 billion ($34 billion).

The group's catastrophe claims came in well under allowance at $751 million ($1 billion), or 4.1 per cent of net insurance revenue.

That was a big improvement from the 5.9 per cent ratio in 2024, despite Cyclone Alfred and several storm and flooding events on Australia's east coast during 2025.

"This is a pleasing outcome in a year where industry losses have been painful," group CEO Andrew Horton told analysts in a conference call, noting the year's devastating California wildfires.

The group wound down its North America middle-market segment beginning in 2024 to focus on specialty, crop and commercial insurance there, leaving it with substantially less property catastrophe exposure.

QBE delivered an adjusted return on equity of 19.8 per cent, up from 18.2 per cent in 2024.

Its combined operating ratio - a metric used to gauge the profitability of insurance companies - improved to 91.9 per cent, from 93.1 per cent in 2024, and beating guidance of 92.5 per cent.

Its investment portfolio delivered a 4.9 per cent return of $US1.6 billion, broadly stable compared to 2025.

Looking ahead, QBE is again forecasting full-year gross written premium growth in the mid-single digits in constant currency terms.

The insurer will pay a final dividend of 78 cents, taking the total payout for 2025 to $1.09, up 25 per cent from its 87 cent per share dividend payout in 2024.

By 11.30am, QBE shares were up 5.8 per cent to $21.26, their highest since mid-October.