Australian grain growers are storing their product on farms rather than shipping it offshore via handlers as falling commodity prices cut into already thin margins.

Shares in GrainCorp, one of Australia's biggest agribusinesses, dropped to multi-year lows on Monday after it downgraded its earnings outlook because of global oversupply and weak returns for grains.

Its received volumes and subsequent exports are also expected to drop as growers opt to store their own grain rather than pay monthly fees to someone else to handle and sell the product.

"Most growers have worked out that the only way they can make money is storing it on their own farms, because the margins are that tight," Grain Producers Australia southern director Andrew Weidemann told AAP.

There are also more agencies competing and putting pressure on GrainCorp's structure.

"In grain production, there's more than a third of the price post the farm gate to get it to an end user and so farmers are looking at how they can participate in that part of the process in the supply chain," Mr Weidemann said.

Strong domestic demand also means growers are opting to sell locally, rather than worry about shipping abroad, further driving their storage needs away from giants like GrainCorp.

The group's projected underlying earnings before interest, tax, depreciation and amortisation for the current financial year are now expected to fall between $200 million and $240 million, down from $308 million in the prior year.

It also projected an underlying net profit after tax of between $20 million and $50 million for the year ending September 2026, down from $87 million previously, missing consensus estimates by more than 60 per cent, according to RBC Capital Markets.

"GNC (GrainCorp) provided a profit warning in December, alluding to the weakness in global trading margins and the propensity of farmers to withhold strong production volumes on farm," RBC analyst Owen Birrell said.

"Today's trading update and profit guidance has highlighted the financial impact of these actions, and GNC's exposure and operating leverage to these actions."

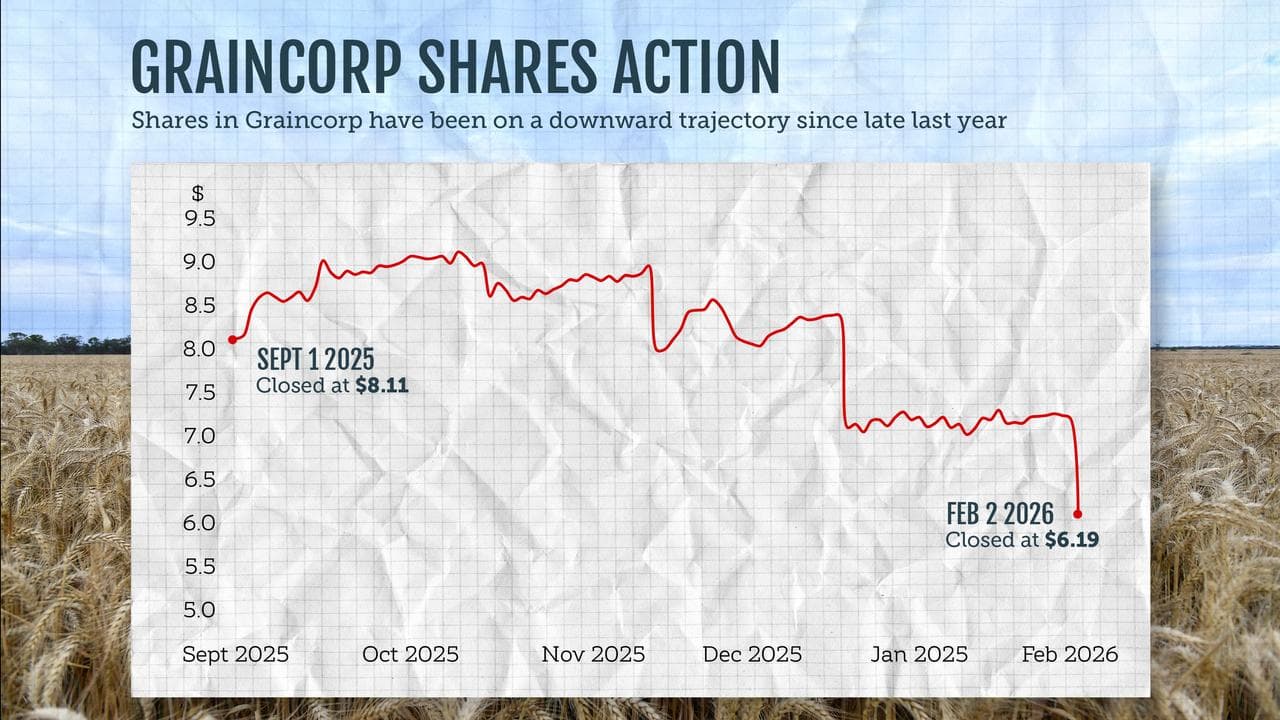

GrainCorp shares plunged 15 per cent to a more than four-year low of $6.12 on Monday.

The stock price is down more than 30 per cent since it delivered its fiscal 2025 results in December.

"Record global production has created an oversupply of grain, outpacing demand growth and placing downward pressure on commodity prices for the whole market," chief executive and managing director Robert Spurway said.

With the east-coast winter harvest substantially complete, the Australian Bureau of Agricultural and Resource Economics and Sciences is predicting a winter crop of 31.2 million tonnes.

However, while GrainCorp's boss conceded market conditions had reduced incentives for growers to deliver grain to market, its strong balance sheet meant it was still well positioned in the market.

"GrainCorp is exercising strong operating discipline in response to the current environment," Mr Spurway said.

“At this point in the cycle, we are accelerating cost management initiatives while continuing to deliver high-quality and reliable services to growers."

GrainCorp will hold its annual general meeting of shareholders in Sydney on February 18.