Australia's share market has been dragged lower as an exodus from precious metals weighed on heavyweight raw materials stocks.

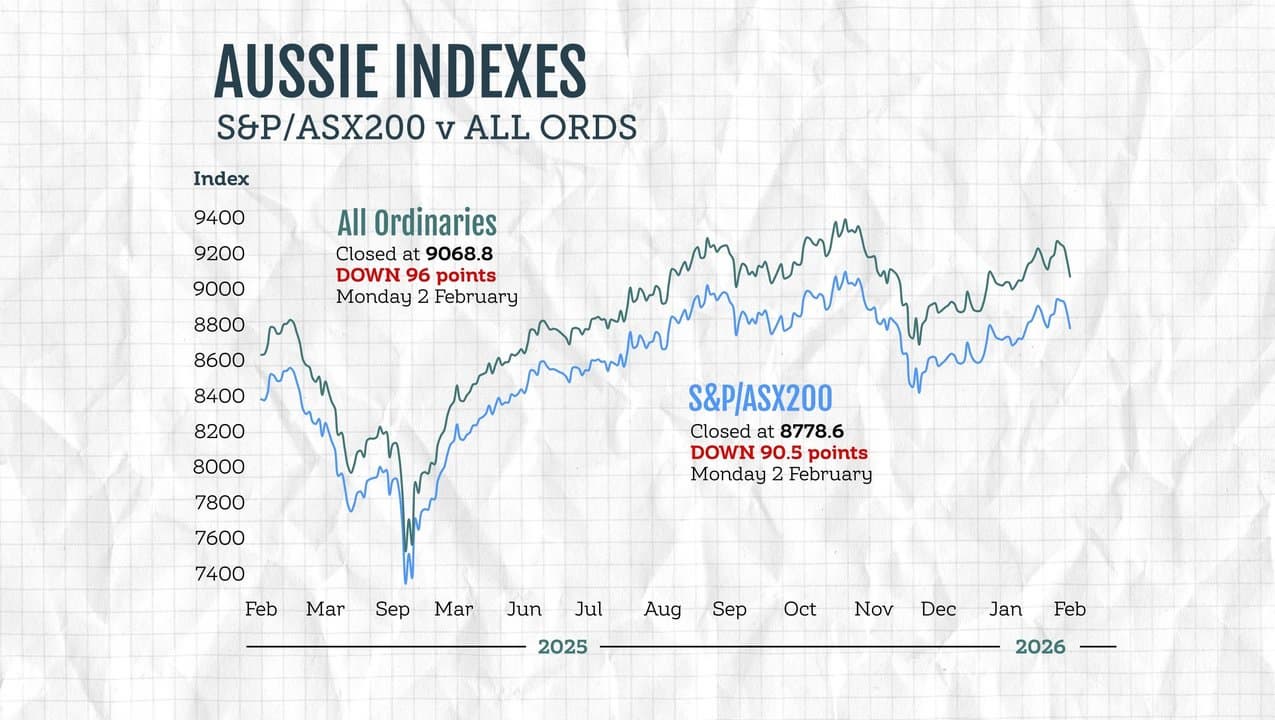

The S&P/ASX200 fell 90.5 points on Monday, down 1.02 per cent to 8,778.6, as the broader All Ordinaries lost 96 points, or 10.5 per cent, to 9,068.8.

A recently red-hot materials sector has handed back more than half its 2026 gains in the previous two sessions, after gravity-defying gold and silver stocks sold off heading into the weekend.

The segment has fallen more than six per cent since Thursday, but a pullback was unsurprising after a more than 50 per cent rally since July.

“The pockets of the market that had been doing well have been brutally exposed today,” IG market analyst Tony Sycamore told AAP.

“The question now is: does this sell-off in precious metals spread or become a contagion in some of the other asset classes?”

ASX-listed gold miners as the commodity's spot price tumbled from a record of $US5,595 ($A8,076) an ounce on Thursday to $US4,655, dragging the All Ordinaries gold sub-industry more than seven per cent lower.

Denver-headquartered producer Newmont Corporation took the top-200's wooden spoon, falling 10 per cent to $17.32.

Mining giants BHP and Rio Tinto couldn't offer any support, dipping more than two per cent and one per cent respectively, as both iron ore futures and copper prices fell.

The segment was largely a sea of red for bigger players except Amcor, PLS Minerals and IGO Limited, which rose more than 1.3 per cent each.

Energy stocks also suffered, the segment dropping two per cent after oil prices sank on hopes the US and Iran could reach a new nuclear deal.

Woodside and Santos dropped 1.8 per cent and 3.3 per cent respectively, while coal miners caught a bid and uranium stocks eased from recent strength.

The heavyweight financials sector advanced a modest 0.1 per cent, as CBA shares rallied 1.4 per cent to $151.48.

ANZ and Westpac traded roughly flat and NAB lost ground.

Heath care stocks were under pressure, shedding 1.7 per cent in a broad-based sell-off.

In company news, GrainCorp shares tumbled 14 per cent to $6.19 after slashing its earnings guidance due to a global grain glut, weak prices and rising on-farm storage.

Nine Entertainment shares are up more than 10 per cent in two sessions after the company unloaded its major radio assets and inked a deal to buy outdoor advertising group QMS.

Bluescope Steel shares lost 1.5 per cent to $29.79 as Tania Archibald took the reins as managing director and chief executive officer, succeeding Mark Vassella.

The Australian dollar is buying 69.39 US cents, down from 70.01 US cents on Friday, with the greenback reclaiming some lost ground after US President Donald Trump's pick to become Federal Reserve chair was more of a hawk than expected.

Ahead of the first Reserve Bank decision of the year on Tuesday, interest rate markets are pricing a 76 per cent probability of a hike, after multiple upside inflation surprises in late 2025.

ON THE ASX:

* The S&P/ASX200 lost 90.5 points, or 10.2 per cent, to 8,778.6

* The broader All Ordinaries fell 96 points, or 1.05 per cent, to 9,068.8

CURRENCY SNAPSHOT:

One Australian dollar trades for:

* 69.26 US cents, from 70.01 US cents at 5pm AEDT on Friday

* 107.27 Japanese yen, from 107.77 Japanese yen

* 58.44 euro cents, from 58.71 euro cents

* 50.65 British pence, from 50.89 British pence

* 115.34 NZ cents, from 115.71 NZ cents