A popular family location-sharing app is ramping up plans to monetise its base of tens of millions of free users by allowing advertisers to send them targeted ads.

Life360 chief revenue officer James Selby told analysts on Tuesday that user subscriptions would continue to be the company's primary focus.

But its recent $US120 million ($181million) acquisition of advertising technology company Nativo means the ASX-listed group can now accelerate its strategy to earn more through advertising.

Investors have reacted sceptically to the Nativo deal, with Life360's share price dropping from over $48 when it was announced on November 10 to $36.35 on Tuesday.

Mr Selby argued that the acquisition would strengthen user privacy by allowing Life360 to keep all user data within its own ecosystem.

"We're building a family super app with multiple revenue pillars that work together," he added.

"We really want to respect that the paid product is for some people, but not for all, so that really creates this meaningful incremental upside without changing our mission, without changing the user experience or the core value proposition."

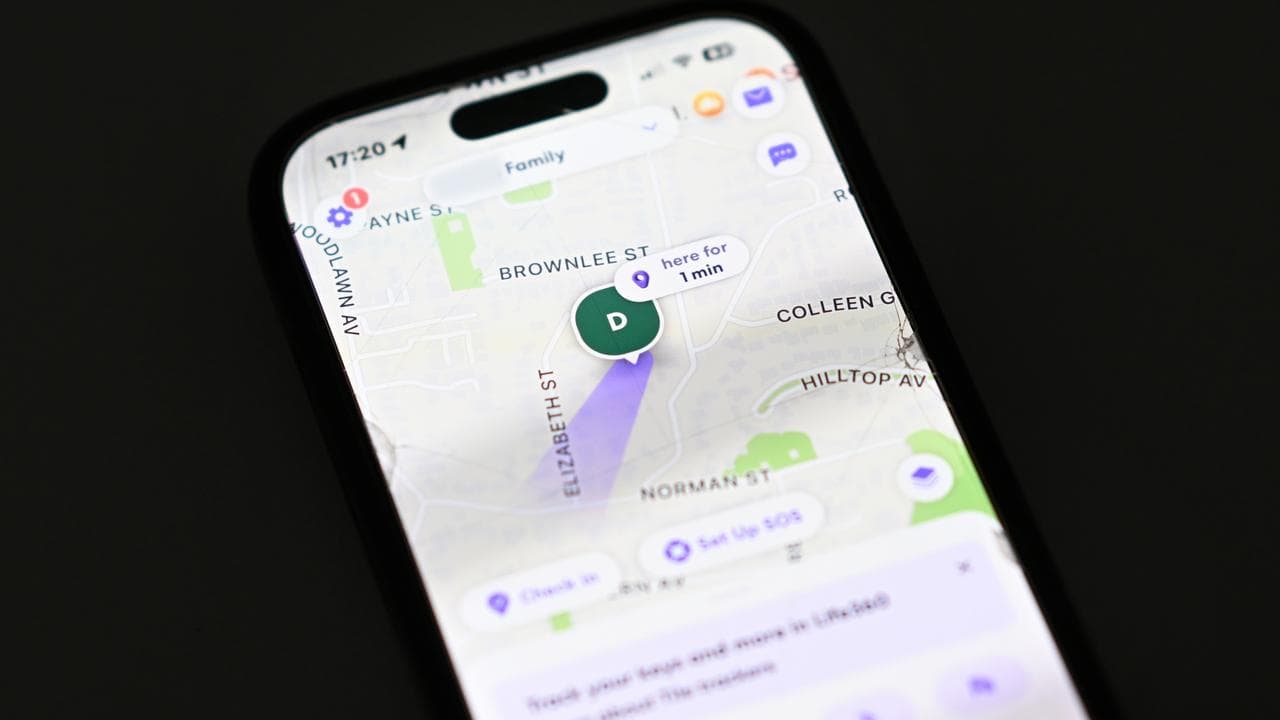

Life360 began as a location-sharing app that allowed family members to share their real-time whereabouts with other users.

It has since rolled out features such as SOS alerts, roadside and medical assistance, severe weather alerts, family driving summaries and pet-finding features using GPS trackers.

The platform had 91.7 million monthly active users worldwide as of September 30, up 19 per cent from a year ago.

It had 3.2 million active users in Australia and New Zealand as of that date, up 28 per cent year-on-year.

Most users belong to Life360's free tier, with 1.9 million US and 800,000 international users opting to pay for subscription plans that range from $9.99 to $29.99 a month.

Life360 won't sell data on individual users, Mr Selby stressed, but it will let advertisers target "big segments" of its users, such as frequent grocery shoppers or people looking to buy a new Toyota car.

Using Nativio's "full-stack" infrastructure, those ads might be delivered to a cohort of Life360 users as they read the Wall Street Journal, for example, Mr Selby explained.

The entire process will stay within Life360's platform, instead of being shared with outside vendors, he said.

"The full stack ownership really means that we have much fewer external companies that we're having to work with, which ensures that the data is not exposed to other providers, which is obviously a security risk," Mr Selby said.

"We provide precision, we provide persistence, we provide household context that no one else has at the scale."

Life360 is dual-listed on the US Nasdaq Global Select Market and the Australian Securities Exchange, where it made its debut in 2019.