Billionaire retailer Solomon Lew warns cost-of-living pressures are taking a toll on consumers, leading to a weaker earnings outlook for his company.

Premier Investments, the parent company of back-to-school brand Smiggle and sleepwear brand Peter Alexander, expects to make $120 million in earnings for the 26 weeks to January 24.

That's down from the $129.4 million generated by the two brands, which are some of Australia's most recognised, during the same period a year ago.

Peter Alexander delivered record sales across the Black Friday and Cyber Monday discount shopping period, but overall consumer sentiment was down.

"You only have to look at what's taking place with people not paying their electricity bills in NSW and other states and having to apply for extended terms," chairman Solomon Lew told reporters following the company's annual general meeting on Friday.

"I can't recall this in all my years in business; ever seen a situation like this previously."

Parts of Australia's economy were doing very well but the majority was under pressure, Mr Lew added.

"The government has got a lot of work to do to get Australia back on track," the 80-year-old retail legend said.

"There are huge issues."

Premier's chief financial officer and interim CEO John Bryce noted expectations for interest rate cuts had fallen in the past month or two and this also weighed on consumer sentiment.

"There's certainly a segment of consumers that are feeling the pressure," he said.

"Non-discretionary costs keep rising, so that does leave less of a consumer wallet to spend in the discretionary retail space."

Consumers faced similar issues in the UK and New Zealand, the other two major markets for the company, Mr Lew noted.

RBC Capital Markets analyst Michael Toner described Premier's first-half earnings guidance as "soft", noting the $120 million forecast was 18 per cent below consensus expectations.

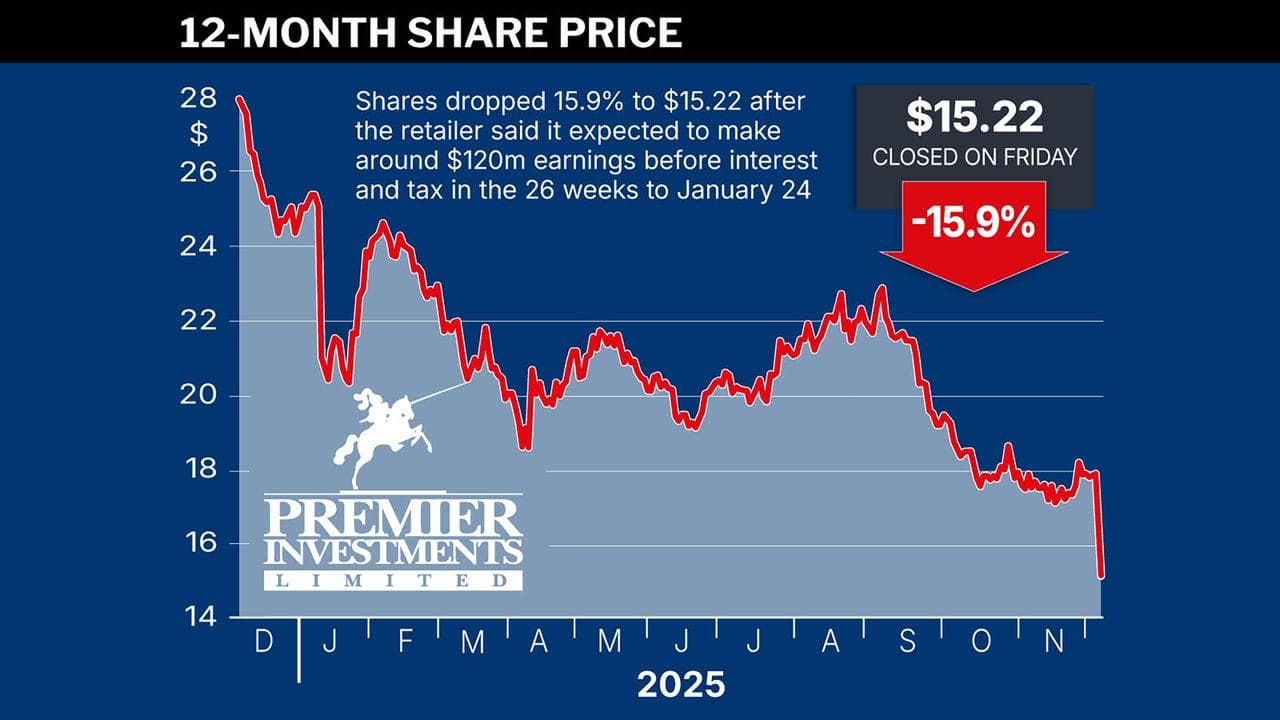

Investors responded by selling, with Premier shares closing 15.9 per cent down to a two-and-a-half year low of $15.22, representing a 37.5 per cent drop since the start of 2025.

"Obviously the board believes the company is undervalued," Mr Lew said.

Premier announced it would use up to $100 million of its $333 million in available cash to buy back shares over the next 12 months, which should provide at least some support for its share price.

In addition to cost-of-living issues, the Smiggle business has faced leadership turmoil after its chief executive left in September 2024 amid disputed misconduct allegations.

Premier in November appointed its internet general manager Georgia Chewing as Smiggle's interim chief operating officer, with Mr Lew describing her as one of the company's best executives.

"It hasn't gone as well as it should have," Mr Lew said, referring to Smiggle's performance.

"But we understand the reasons. And a big part of it is, of course, the economy."

Smiggle has a number of upcoming collaborations in place for movie-themed goods and "absolutely hot products at good prices", Mr Lew said.

Premier sold its Apparel Brands, including Just Jeans and Jay Jays, to Myer in a transaction that completed in January.