Australia's largest steelmaker will give hundreds of million of dollars to shareholders via a special dividend, a move it says is unrelated to a rejected $13 billion takeover.

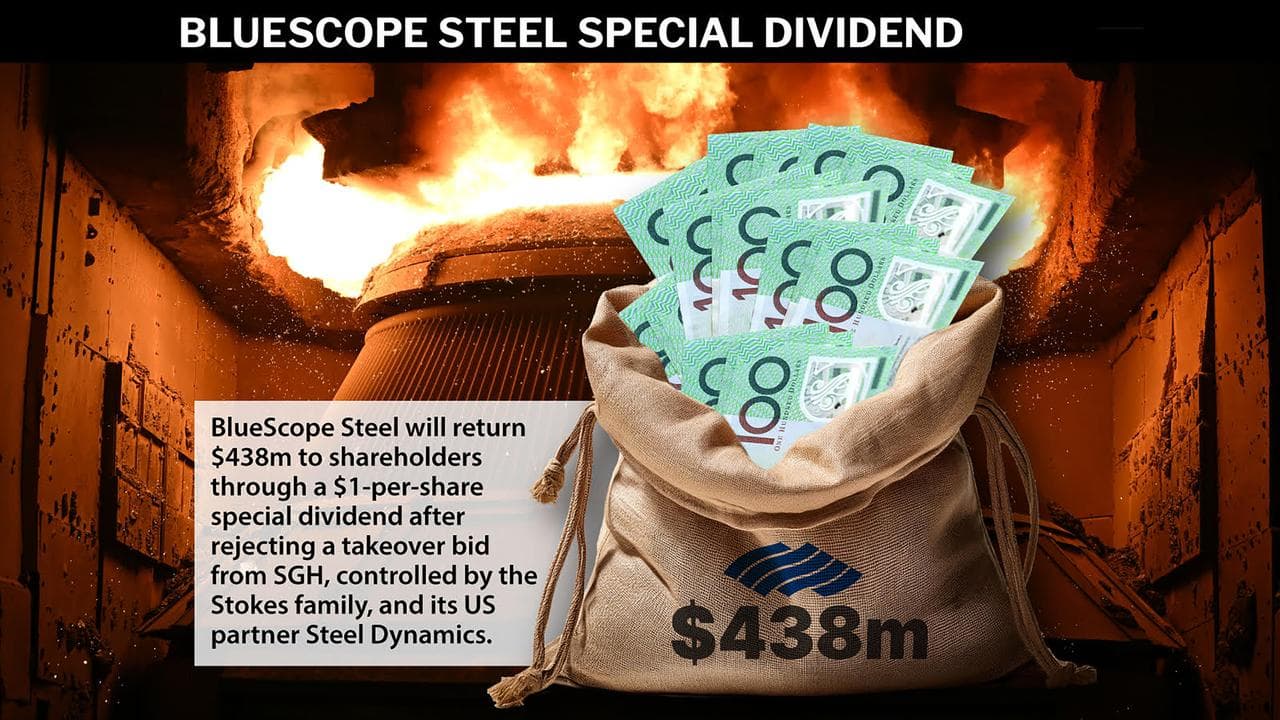

BlueScope Steel investors will receive $438 million under a special payout of $1 per share after its board rejected the offer from the Stokes family-controlled SGH and its American bid partner Steel Dynamics.

The cash payout will be funded from surplus cash generated from asset sales, including its 50 per cent interest in the Tata BlueScope joint venture providing coated steel products for the Indian market.

The Illawarra-based steelworks operator has also offloaded 33 hectares in West Dapto, near the facility on the NSW south coast, for $76 million, and is releasing about $200 million of working capital from "residual" projects in its property division.

"This dividend decision is part of BlueScope’s established capital management framework and is independent of any prior or potential future proposals for the company," it said in a statement on Wednesday.

But the dividend isn't particularly capital efficient, because Bluescope lacks the available credits to make it a franked payout.

Australian companies in that position typically would elect to return capital to shareholders via a on-market share buyback rather than an unfranked dividend, but BlueScope said a buyback was not an option "in light of corporate activity and regulatory settings".

BlueScope rejected a $13.2 billion takeover offer last week that would have broken up the group, with its Australian assets going to SGH and the US business going to Steel Dynamics.

SGH and its partner are yet to formally respond to the rejection of their non-binding offer, which BlueScope said dramatically undervalued its assets.

The original offer was $30 per share, but the consortium said any dividends paid after December 12 would reduce the proposal price, so the offer on the table is now $29 per share.

BlueScope shares closed Wednesday at $29.76, down 0.3 per cent from Tuesday's close.

The SGH/Steel Dynamics offer was made on December 12, but only came to light on January 5 when it was also revealed Steel Dynamics had made three unsuccessful previous approaches to take control of BlueScope.

"This special dividend demonstrates BlueScope’s ability to generate and distribute returns to its shareholders," CEO Mark Vassella said.

"With a clear line of sight to the completion of our current significant capital investment program, BlueScope is positioned to not only return to the robust cash generation it has been known for, but to strengthen it further with the enhanced earnings of the business."

The special dividend will be paid on February 24, after BlueScope releases its first half results on February 16.

Morningstar equity analyst Esther Holloway told AAP the special dividend represented good capital management after the Bluescope's asset sales and cost savings, and that she didn't read anything into it in the context of the recent bid.