Atlassian is "building a bloody great business", its founder says, as its US market stock falls to a seven-year low amid growing losses and a wider software sector sell-off.

The Sydney-quartered software company delivered $US1.6 billion ($A2.3 billion) in revenue in the three months to December 31, up 23 per cent from a year ago and ahead of expectations.

Its net loss for the quarter widened to $US42.6 million ($A61 million), however, up from $US38.2 million ($A54.7 million) a year ago.

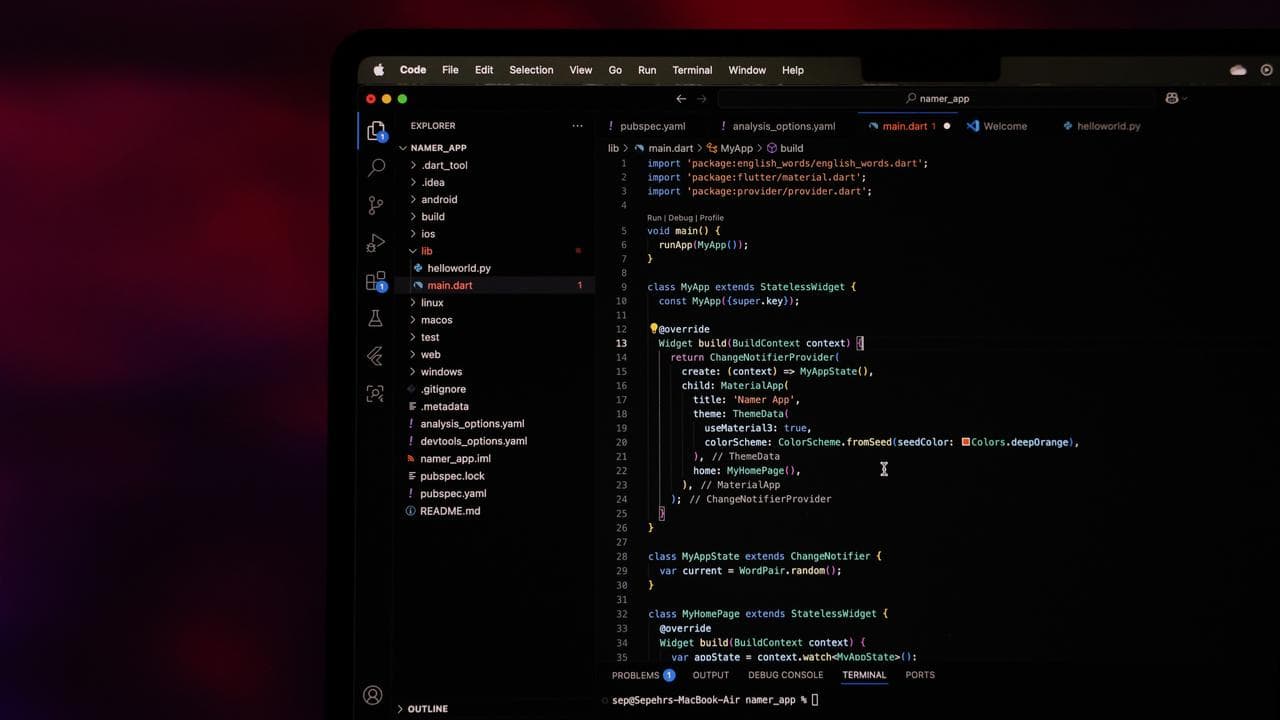

Atlassian makes a suite of cloud-based collaboration tools, including Jira and Trello, used for software development and project management.

It said on Friday it now had more than 350,000 customers, including 80 per cent of the Fortune 500.

"We had a fantastic Q2. We’re building a bloody great business," Atlassian co-founder and CEO Mike Cannon-Brookes told shareholders in a letter.

Still, Atlassian's Nasdaq-listed shares dropped 6.3 per cent to $US98.41 on Thursday - the lowest level since early 2019 and representing a 69.3 per cent loss in the past 12 months.

After Atlassian's second-quarter results were released on Friday morning Australian time, its TEAM shares fell further in US after-hours trading, dropping 3.6 per cent to $US94.51.

A major sell-off has hit US software stocks this week, partly fuelled by artificial intelligence company Anthropic releasing a plug-in that can apparently automate high-level legal work.

It led to investor fears AI agents could disrupt the business models of highly profitable software-as-a-service firms - the darlings of the tech sector for their stable, subscription-based revenue models.

The US S&P500 software and service index tumbled 4.7 per cent and has fallen 20.9 per cent in the past month to its lowest level since April, in a sell-off dubbed "software-mageddon" and "Saasocalypse".

Major names hit by the rout include Microsoft, Salesforce and Thomson Reuters, as well as Xero, which is listed on the Australian exchange.

"I'm convinced AI is great for Atlassian," Mr Cannon-Brookes said in his shareholder letter.

"Others think software is dead."

Mr Cannon-Brookes told analysts in a conference call that thousands of customers were using Atlassian's AI code-generation tools to increase productivity.

"As I've said before, AI is the best thing to happen to Atlassian," he said.

Enterprise customers, he said, needed a platform that was trustworthy, compliant and secure.

"AI enables us to do that better than we ever have in our domain of helping their teams to collaborate and be better," he said.

Responding to an analyst who sympathised with the share price drop despite what he described as a strong quarter, Mr Cannon-Brookes said, "Appreciate the sound the kind words - you seem as frustrated as we are," before describing how Anthropic was a great partner of Atlassian and the company used several of its tools.