Destructive hailstorms and thunderstorms resulted in tens of thousands of insurance claims for one of the nation's biggest insurers, denting its interim earnings.

Suncorp paid out $542 million in claims from one storm alone, a November 25 thunderstorm that damaged vehicles and property across southeastern Australia.

That storm, which belted southeast Queensland with baseball-sized hail measuring 9cm in diameter, is likely to be one of the costliest in Suncorp's recent history.

Thunderstorms struck eastern Australia and New Zealand on October 25, resulting in Suncorp having to pay out $358 million in claims.

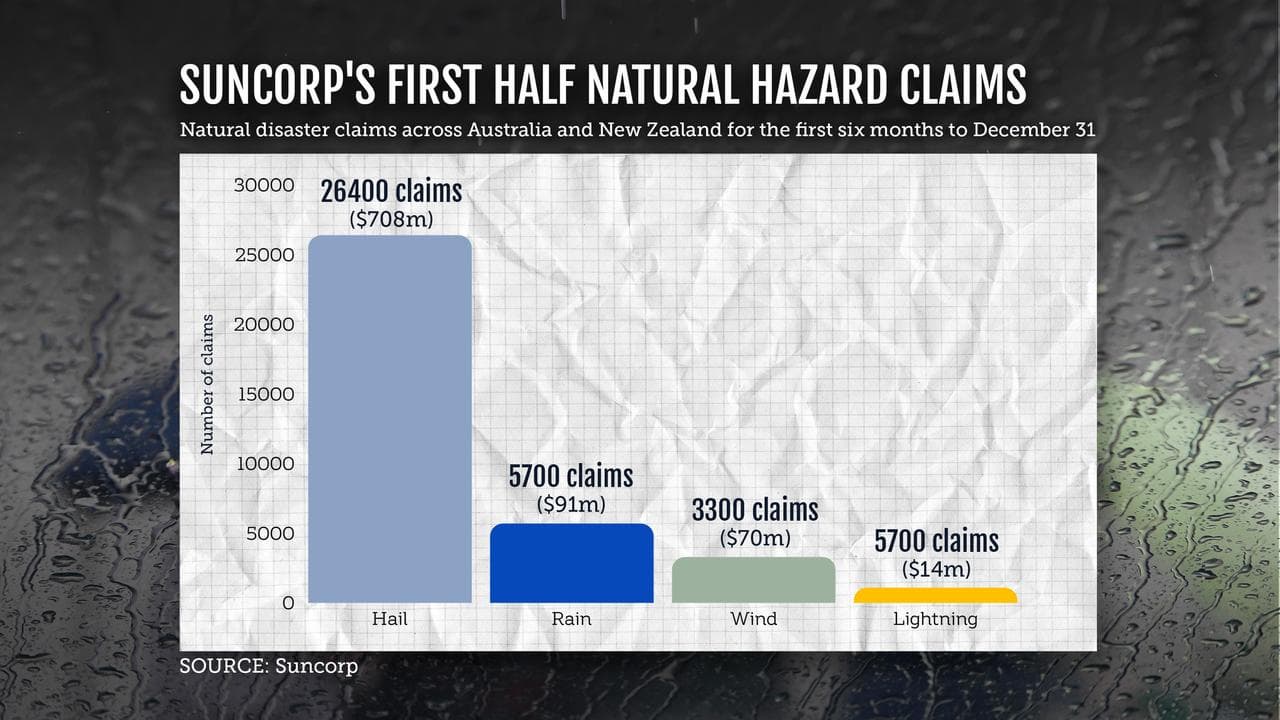

Overall, Suncorp received 71,000 natural hazard claims during the half year to December.

Suncorp paid out $1.3 billion in total, which was $453 million above its natural hazard allowance.

Most of the damage involved hail, with 26,400 hail-related claims totalling $708 million in damages.

"This has been a challenging half, for the entire insurance industry, with the extreme weather events," Suncorp CEO Steve Johnston said on Wednesday.

Suncorp is supporting customers impacted by the severe weather events and continues to finalise earlier complex claims, including from ex-Tropical Cyclone Alfred and flooding in Queensland and NSW.

Chief financial officer Jeremy Robson said the hail events were "relatively random in terms of weather patterns" and there was a less-than-clear connection to climate change dynamics.

Suncorp on Wednesday reported a 76 per cent fall in net profit for the first half of 2025/26 to $263 million, from $1.1 billion a year ago.

Cash earnings also dropped sharply, to $270 million from $828 million.

Suncorp collected $7.69 billion in gross written premiums, up 2.7 per cent from a year ago in the six months ended December 30.

The company noted it used 15 different AI chatbots to handle more than 1.6 million digital customer interactions in the half, up more than 28 per cent.

Shares in Suncorp, which declared a first-half dividend of 17 cents, fell more than four per cent to $15.33 in lunchtime trading on Wednesday.