Australia's share market has clutched a second session of gains, led by a strong performance from mega miner BHP, which helped offset weak performances elsewhere.

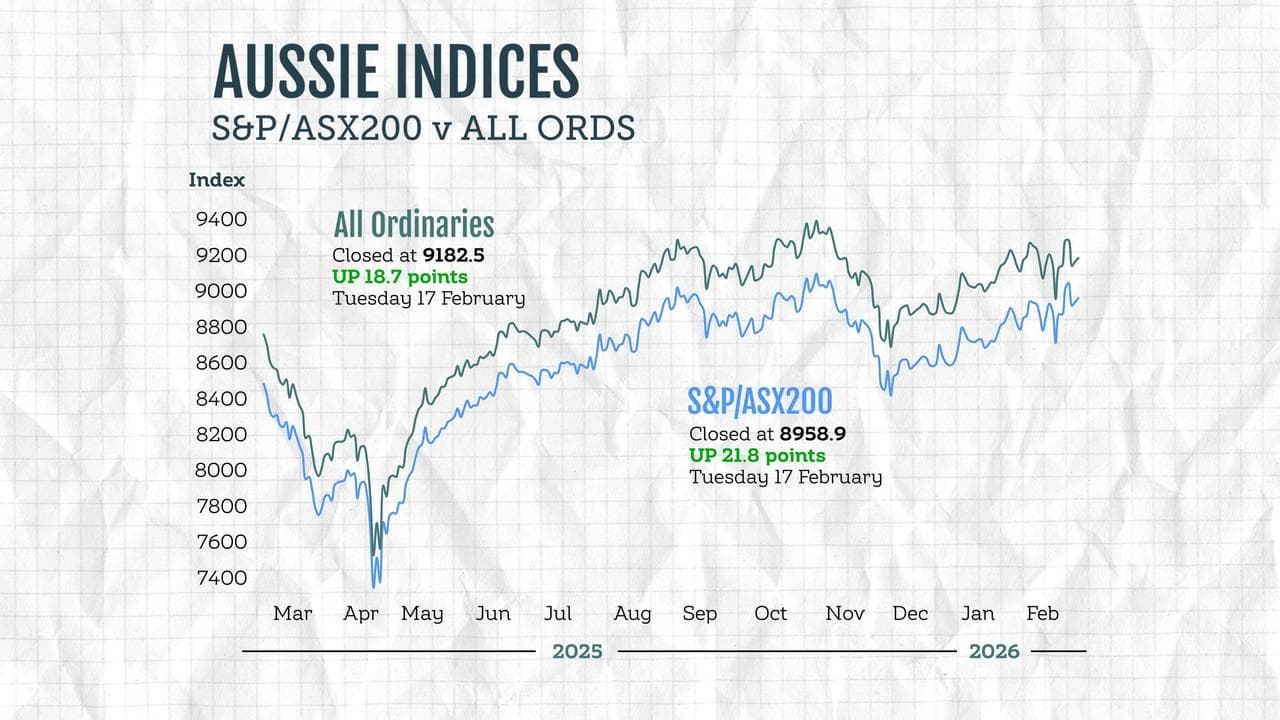

The S&P/ASX200 edged 21.8 points higher on Tuesday, up 0.24 per cent, to 8,958.9, as the broader All Ordinaries rose 18.7 points, or 0.2 per cent, to 9,182.5.

"With US markets closed overnight for Presidents Day and several Asian markets shut for Lunar New Year, local earnings have taken centre stage – and BHP has comfortably stolen the show," IG market analyst Tony Sycamore said.

"BHP delivered a blockbuster first-half result, sending its share price up more than 7.5 per cent to a record high of $54.20, before easing back to close 4.7 per cent higher at $52.74."

The move added an extra $11 billion to the miner's market cap, taking it to a valuation of $267 billion.

Only four of 11 local sectors ended the day higher, led by a 1.3 per cent boost to raw materials thanks largely to BHP, as gold miners retreated and other sub-sectors were mixed.

Gold itself eased to $US4,898 (A6,937) an ounce, as US dollar strength and risk-on sentiment weighed on the safe haven.

The heavyweight financials sector traded just below flat as Westpac carved out a 0.3 per cent lift and its remaining big four competitors fell behind.

NAB shares fell 0.4 per cent ahead of its first-quarter results announcement on Wednesday.

Energy stocks dipped 0.4 per cent, tracking with a similar move in oil prices ahead of more US-Iran talks over the latter's nuclear program.

Elsewhere in the segment, coal miners traded lower and uranium stocks were mixed.

Consumer discretionary stocks had a positive day, up 0.5 per cent, with help from JB Hi-Fi after it's share price jumped by roughly one-fifth in two sessions since reporting a 7.4 per cent sales jump in the recent half.

In other earnings news, Seek fell more than three per cent after it reported a $178 million loss, due in part to an impairment on its stake in Chinese jobs platform Zhaopin.

Shares in Baby Bunting Group rocketed more than eight per cent higher after the maternity and baby goods company posted a 44 per cent increase in first-half underlying net profit compared to the prior corresponding period.

The Lottery Corporation, Suncorp, NAB, Mirvac and GrainCorp will hand down interim results on Wednesday.

The Australian dollar is buying 70.62 US cents, down from 70.88 US cents on Monday at 5pm, dipping slightly following the release of the Reserve Bank's February meeting minutes.

"While the board cited stronger activity, resilient consumer spending and persistent price pressures as justification for February’s tightening, the absence of a pre-set rate path has kept the currency subdued," Zerocap analyst Emir Ibrahim said.

"Attention now shifts to this week’s wage price index and labour market data for confirmation on whether domestic strength is sufficient to sustain the RBA’s hawkish bias."

ON THE ASX:

* The S&P/ASX200 rose 21.8 points, or 0.24 per cent, to 8,958.9

* The broader All Ordinaries gained 18.7 points, or 0.2 per cent, to 9,182.5

CURRENCY SNAPSHOT:

One Australian dollar trades for:

* 70.62 US cents, from 70.88 US cents at 5pm AEDT on Monday

* 108.01 Japanese yen, from 108.58 Japanese yen

* 59.64 euro cents, from 59.73 euro cents

* 51.90 British pence, from 51.96 British pence

* 117.06 NZ cents, from 117.42 NZ cents