Inflation back within target, an economy that's still growing and an unemployment rate "with a four in front of it" is the soft landing the federal treasurer is targeting.

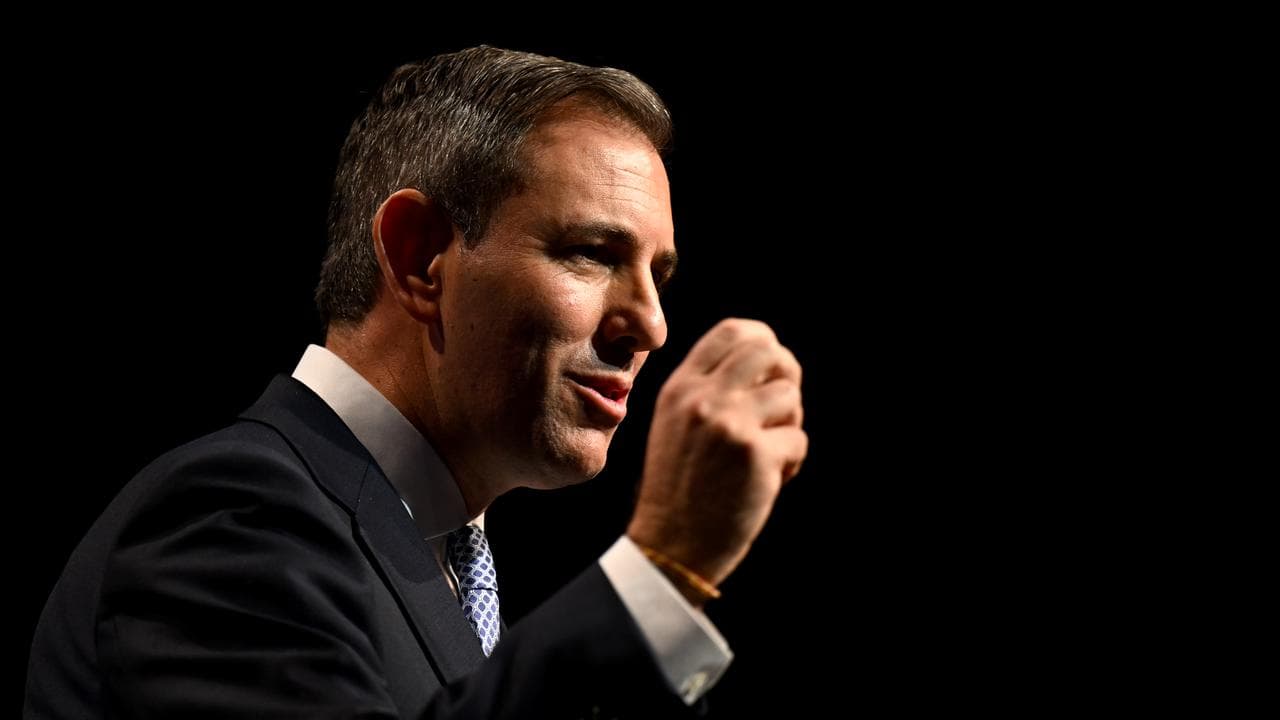

Jim Chalmers remains cautiously confident the Australian economy can avoid a recession while taming inflation, he said during a speech on Wednesday, and believes his government's budget management is helping.

The treasurer has been defending the May budget from criticism it adds too much new spending at a time when inflation remains above target.

Dr Chalmers asserts a "slash and burn" federal budget would be irresponsible at at time when growth has slowed to a crawl, lifting just 0.1 per cent in the March quarter and 1.1 per cent over the year.

"This is what a soft landing on a narrow runway looks like," he said in the speech to the Morgan Stanley Australia Summit.

"An economy still growing, inflation coming back to band, unemployment with a four in front of it, tax cuts and rising wages supporting a gradual recovery in consumption, and a sensible approach to budget repair to buffer us against uncertainty."

Shadow Treasurer Angus Taylor argued the government was "slamming the accelerator" when the Reserve Bank of Australia had its "foot on the brake".

“The treasurer likes to create the illusion that he understands what the economy needs," Mr Taylor said in response to Dr Chalmers' speech.

"But his actions prove otherwise."

May labour force statistics, due on Thursday, are expected to show ongoing resilience.

The jobless rate has been holding well below long-run averages but has been gradually edging higher, which is an expected consequence of a slowing economy.

In a further sign of cooling in the jobs market, the number of open roles posted to jobs marketplace Seek has been trending lower.

In May, job ads fell 0.6 per cent from April, to be down 17.9 per cent over the year.

Global economic headwinds also continue to buffet the Australian economy.

In its latest Global Economic Prospects report, the World Bank predicts global growth will stabilise at 2.6 per cent in 2024 before edging up to an average of 2.7 per cent in 2025/26 - well below the 3.1 per cent average in the decade before COVID-19.

Global inflation is also taking longer to get under control than previously hoped, causing many central banks to keep interest rates higher for longer.

The figure is expected to moderate to 3.5 per cent in 2024 and 2.9 per cent in 2025.

“Although food and energy prices have moderated across the world, core inflation remains relatively high - and could stay that way," said Ayhan Kose, the World Bank’s deputy chief economist.

"An environment of 'higher-for-longer' rates would mean tighter global financial conditions and much weaker growth in developing economies."