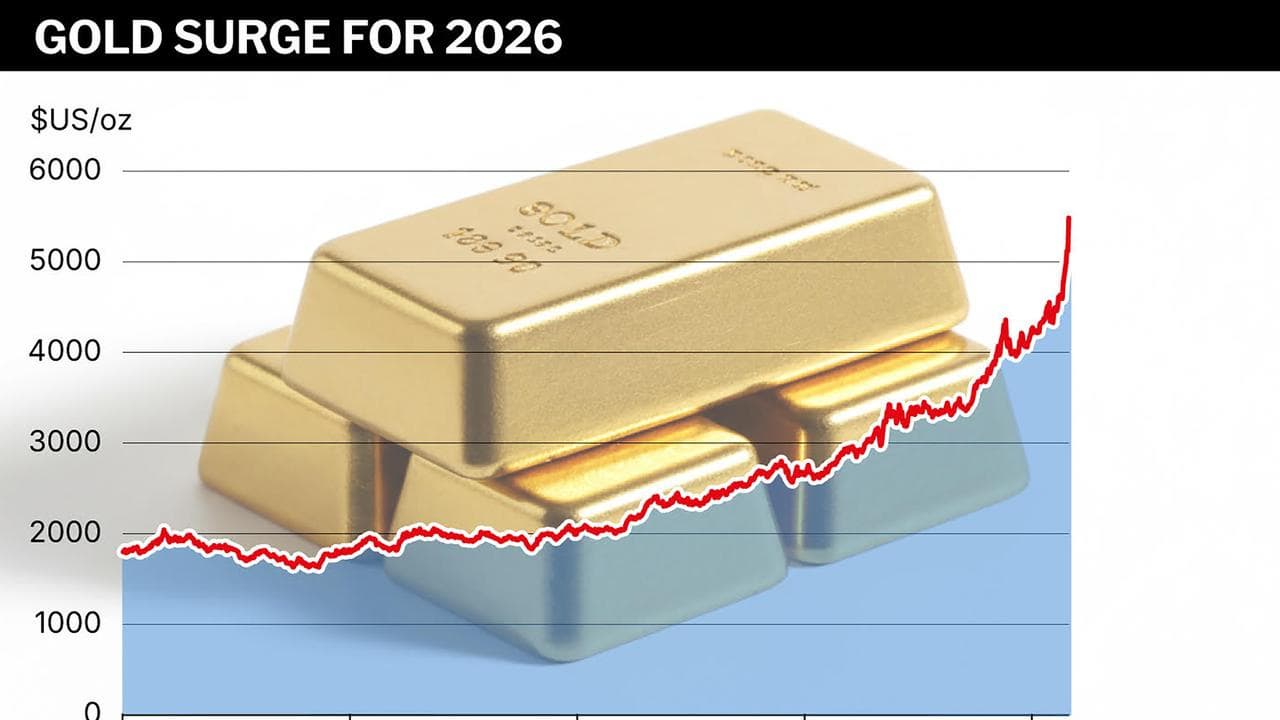

Precious metals have been setting record after record in 2026 - and the rally shows no signs of stopping with Donald Trump in the White House.

On Thursday gold broke through the $US5,500 an ounce level for the first time ever, just two days after breaking through $US5,000.

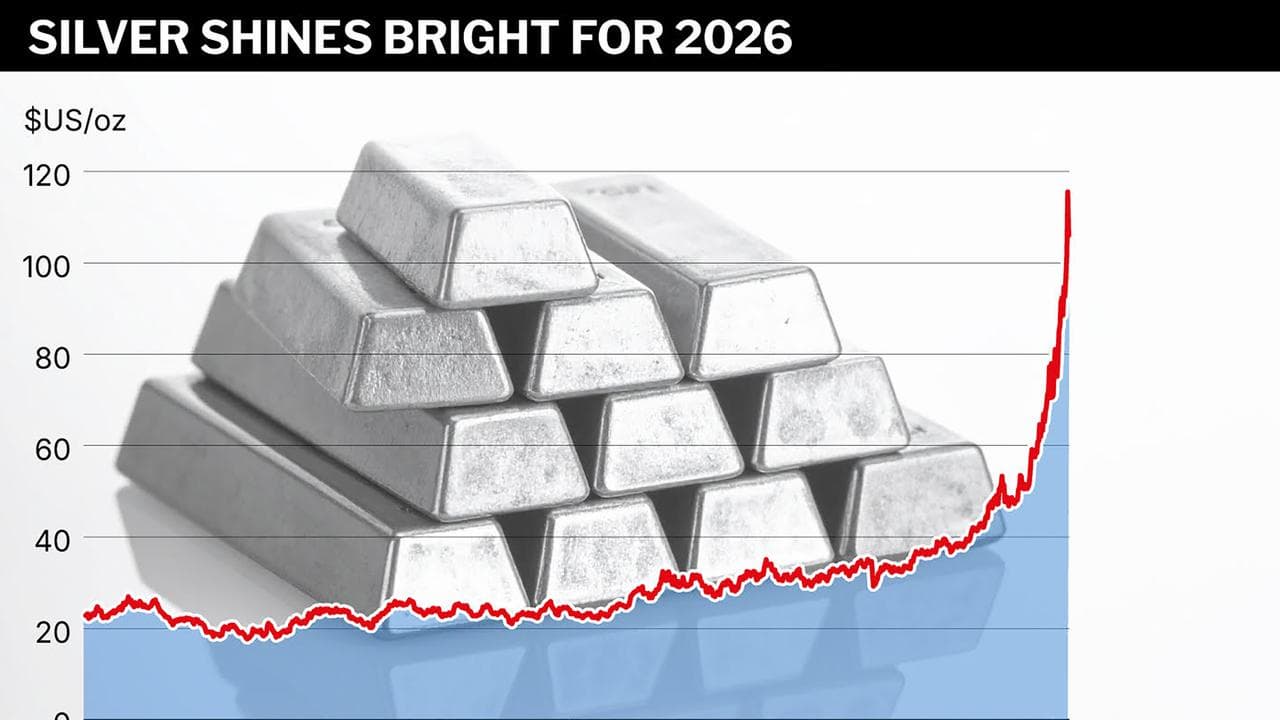

Silver similarly was trading for $US117, less than a week after exceeding $US100 an ounce for the first time ever.

Over the past 12 months, gold has doubled in value and silver has nearly quadrupled.

"Obviously, gold is very, very strong," said Tim Carleton, chief investment officer with Auscap Asset Management in Sydney.

"And the interesting thing about gold being strong is generally, despite a lot of conversations around the lines in Martin Place, fund managers feel underweight."

There's none of the "euphoric behaviour" that would be associated with a bubble, Mr Carleton said. "So it's definitely a bull market."

Stephen Miller, investment specialist with GSFM Funds Management, said there was a number of reasons for gold's amazing rally.

Mr Trump has pressured the Federal Reserve to lower US interest rates, and there's the prospect that a politically pliant Fed might go along with that, Mr Miller said.

There's also been an extraordinary amount of geopolitical turmoil that has increased demand for the safe haven asset, he said.

"What we're seeing in terms of the Western alliance, we haven't seen since World War II," he said. "So that's driving gold as well."

Mr Carleton had a somewhat different take, however, saying that most investors own gold through exchange-traded funds (ETFs), and the total amount of gold held in ETFs is just 10 or 11 per cent - less than it was in 2021.

"So it looks to us as though it's more likely be to central bank driven, and that's very difficult to analyse," he said.

The two main buyers of gold over the past decade have been the central banks of India and China, which only release data on their purchases very sporadically, Mr Carleton said.

"So it's, just very, very difficult to analyse, and as a result, it's very difficult to call it a speculative bubble," he said.

Jack Janasiewicz, portfolio manager for Natixis IM Solutions, said that American sanctions of US dollar assets had also undermined the greenback's dominance.

"If you want to weaponise the USD by sanctioning USD assets, then people will move away from the USD," he said. "And that means gold."

Precious metals have also been financialised, with anyone able to easily buy gold and silver via ETFs, including 3x leveraged ETFs, Mr Janasiewicz said.

That means retail investors "can jump in and push this thing far beyond what some might think reasonable," he said.