A court has slapped an extra $10 million on top of ANZ's record fine for widespread misconduct and systemic failures.

The historic punishment followed a probe by the corporate regulator, which found the big-four bank ignored hundreds of customer hardship notices, misrepresented and failed to pay savings rates and failed to refund fees charged to thousands of dead people's accounts.

ANZ also mismanaged a $14 billion bond deal on behalf of the federal government.

The new total of $250 million in penalties for the four matters is the largest the Australian Securities and Investments Commission has secured against a single entity.

On Friday, Federal Court Justice Jonathan Beach increased the penalty for inaccurate reporting of secondary bond market turnover data by $10 million, taking the total penalty for the issue to $50 million.

"ANZ did not act conscionably, did not act transparently, nor did it trade in the way in which it said it would," he said in his decision.

The bond trading matter exposed the federal government to significant risks.

ANZ misled the Commonwealth for nearly two years by overstating bond trading volumes by billions of dollars, ASIC chair Joe Longo said on Friday.

"ASIC estimates ANZ’s trading misconduct cost up to $26 million, reducing funds that could have supported essential public services," he said.

"ANZ is a critical part of Australia’s banking system and, frankly, they must do better."

The record penalty underscored the seriousness of ANZ's misconduct and its consequences for the government, taxpayers and tens of thousands of customers, the corporate watchdog said.

"ANZ must overhaul its non-financial risk management and put the interests of clients, customers and the public first," Mr Longo said.

The extra $10 million in penalties came a day after ANZ's board decided not to follow their new chief executive and sacrifice some of their fees in a spirit of accountability after a rocky few months.

The board had already stripped several executives of their short-term variable incentive payments over the issue, including former chief executive Shayne Elliott.

Mr Elliot, who lost $13.5 million in bonuses, fired back recently by filing legal action in the NSW Supreme Court to recoup the money.

Nuno Matos, who replaced Mr Elliot in May, has volunteered not to receive a short-term bonus for 2024/25 in recognition of issues at the bank, even though they predated his arrival.

Shareholders at Thursday's annual general meeting delivered ANZ an embarrassing "second strike" on executive pay.

About two-thirds of votes were cast in favour of its executive remuneration report, short of the 75 per cent required.

ANZ said almost all of the financial impact of the $250 million in penalties and legal costs would be covered by existing provisions.

"ANZ is focused on significantly improving its management of non-financial risk across the bank," it said in a statement on Friday.

Meanwhile, the board has appointed independent legal counsel to investigate the bond-trading mismanagement.

It has also tapped an external reviewer to look into the issues with its long-awaited $1.6 billion technology platform, ANZ Plus, after a botched rollout.

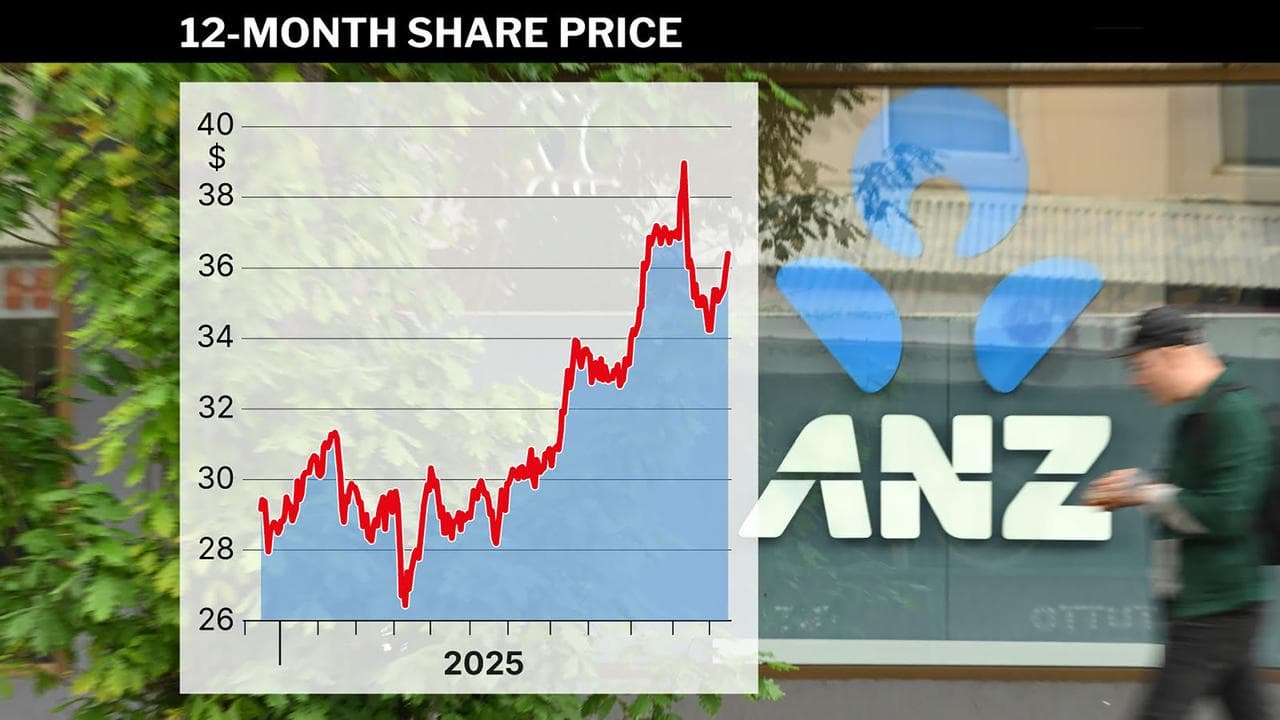

ANZ shares were trading up almost one per cent to $36.28 on Friday afternoon.